32+ can you lock in a mortgage rate

If you want to lock in a. Web The biggest risk of locking in your mortgage rate early is that your rate lock could expire before you close.

Tim Duy S Fed Watch February 2015

Web Imagine that you lock in a 30-year fixed-rate mortgage at a 45 rate for 30 days.

. Web A mortgage rate lock refers to an agreement between the lender and the borrower. Web 150-days Locked In Mortgage Rates Terms and conditions may apply. Web Mortgage lenders typically offer rate locks for 30 45 or 60 days although its possible that a rate lock with a longer term could be available.

Web Most mortgage lenders offer you the option to lock in your mortgage rate after your loan application has been pre-approved. Can you take the lower. Check with your lender.

Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified. And then a week later the market rate drops to 425. Web The primary benefit of locking in a mortgage rate is that youre protected from interest rate hikes.

Through this agreement borrowers can lock the rate of their variable rate interest for a. These nesto promotional rates are for high-ratio mortgages in Ontario. For instance a float-down provision.

Web For borrowers who want a shorter mortgage the average rate on a 15-year fixed mortgage is 632 up 006 from the previous week. Contact your lender before this happens to see what your options are. This means you wont need to worry about rates.

In most instances you can lock your. If rates rise during the closing process your locked-in. Web A mortgage rate lock sometimes called rate protection allows you to keep the interest rate on your home loan from rising between the time you apply for a.

Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days. It depends on the lender loan type loan terms and where you live. Web How Long Can You Usually Lock In a Mortgage Rate.

Web Youd pay an additional fee usually 05 to 1 of the loan amount to drop your locked-in rate to current mortgage rates. Youll want to implement the lock. Web A mortgage rate lock guarantees the current rate of interest on a home loan while a home buyer proceeds through the purchase and closing process.

Web Mortgage rates can change daily and a rate lock protects your interest rate from rising before closing as long as its within the specified time frame and there are.

Govt Initiatives

Can I Unlock A Mortgage If Interest Rates Drop 2 Strategies

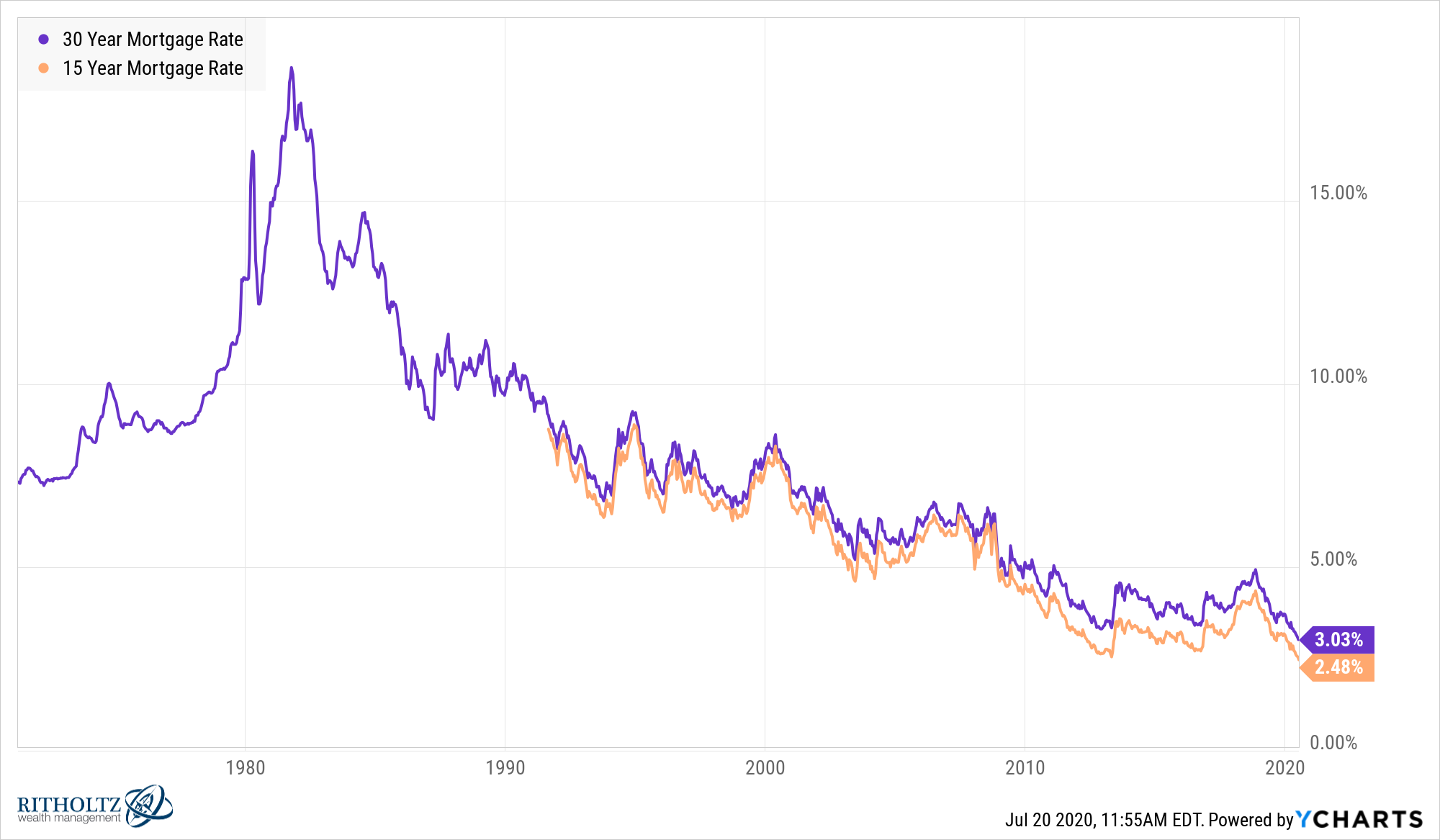

Should You Pay Off Your Mortgage Early With Rates So Low

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

Top 10 Mortgage Mistakes To Avoid

When Should A Buyer Lock In Their Mortgage Interest Rate Jvm Lending

When Should You Lock In A Mortgage Rate Debt Com

Mortgage Rate Lock When Should I Lock In My Interest Rate Moreira Team Mortgage

Mortgage Rate Lock How And When To Lock In Quicken Loans

When Should You Lock In A Mortgage Rate Debt Com

Should You Lock Your Mortgage Rate Today Forbes Advisor

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

When Mortgage Rate Locks Expire Mortgages The New York Times

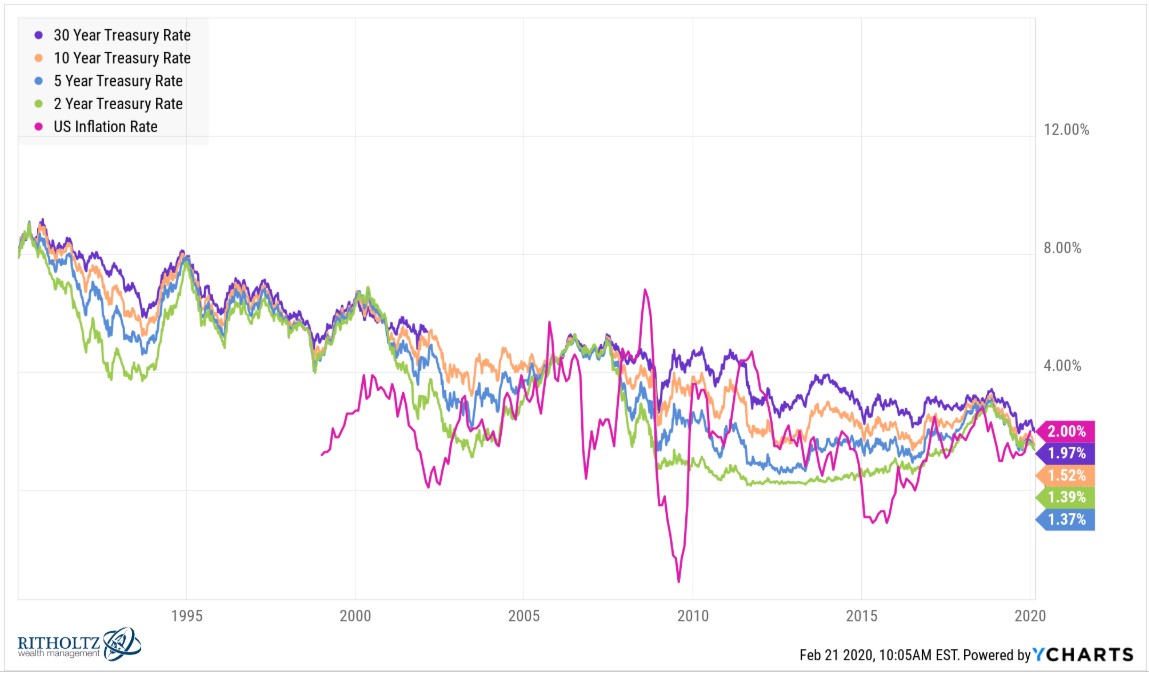

Inflation Worries Pressure Reits Seeking Alpha

:max_bytes(150000):strip_icc()/shutterstock_202412650.lock.in.rates.mortgage.resized-5bfc313746e0fb005145dfee.jpg)

Got A Good Mortgage Rate Lock It In

Why Are Mortgage Rates Different

Why It S Super Important To Lock Your Mortgage Rate