Sep ira contribution calculator

Self-employment tax less your SEP IRA contribution. They may be able to make traditional IRA contributions to the SEP-IRA of up to 6000 7000 for employees age 50 or older for the 2021 or 2022 tax year.

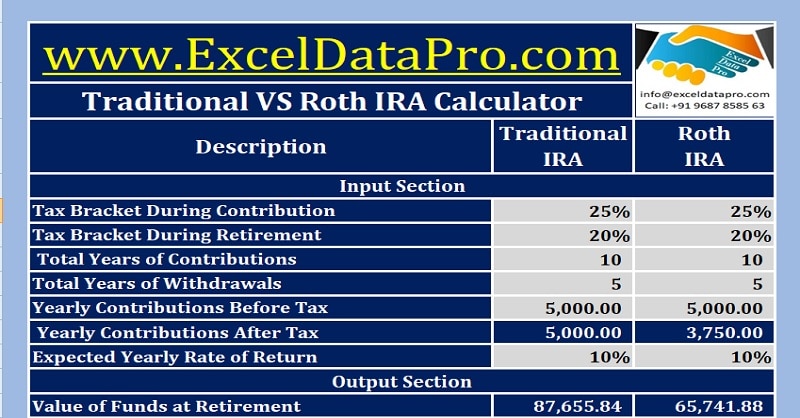

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

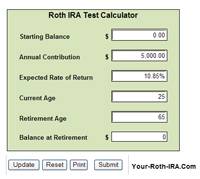

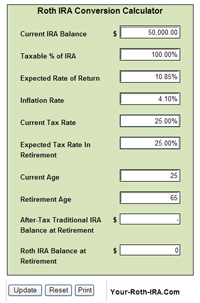

To calculate Roth IRA with after-tax inputs please use our Roth IRA Calculator.

. Based on your inputs the free SEP IRA calculator above determines your SEP IRA contribution limit which is 25 percent of taxable income up to 55000. How to Calculate Amortization Expense. 25 of the employees compensation or 61000 for 2022 58000 for 2021 and 57000 for 2020.

Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. Find a Dedicated Financial Advisor Now. For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for 2022 58000 for 2021.

You can contribute up to 25 of an employees total compensation or a maximum of 58000 in tax for 2021 for 365 days or 61000 for 2022 service year whichever is less. New Reason To Talk to A Financial Advisor. The starting point to determine the individuals earned income is the net.

Consider a defined benefit plan as an alternative to a SEP IRA if you are self employed and would like to contribute more than the 2022 SEP IRA contribution limit of 61000. Unlike other plans employees cant defer their salary to make contributions to a SEP-IRA. How Why and Where.

How to Calculate Cost of Goods Sold. Individual 401 k Contribution Comparison. SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an employees SEP-IRA cannot exceed the lesser of.

Ad Simplify The Road To Retirement. You will need to have your income tax forms nearby particularly Form 1040 and Schedule C Schedule C-EZ or Schedule K-1. It Is Easy To Get Started.

If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan contributions for yourself. How to Calculate Self-Employment Tax. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Earned Income Net Profit 12 of Self-Employment Tax Contribution Plan Information Type of business Contribution tax year Current age 1 to 120. SEP IRA contributions are made at the discretion of the employer and are not required to be annual or ongoing. Read schedule 4 MINS.

For comparison purposes Roth IRA and regular taxable savings will be converted to after-tax values. This is up from 58000 in 2021. How to Calculate Depreciation Expense.

This amount is the total contribution allowed by the IRS that. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Supplementing your 401k or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones.

For example you might decide to contribute 10 of each participants. Build Your Future With a Firm that has 85 Years of Retirement Experience. SEP IRA Calculator Home Calculator How much can I contribute into a SEP IRA.

One of the nicest features of the SEP plan is the large amount you can put away for retirement. Learn More About Schwab IRAs And Start Investing Today. Compensation for a self-employed individual sole proprietor partner or corporate owner is that persons earned income in the case of a sole proprietor or partnership and W-2 income if the business is a corporation.

You can calculate your plan contributions using the tables and worksheets in Publication 560. Is SEP contribution 20 or 25. SEP IRA Calculator To determine how much you can contribute to a SEP IRA based on your income use the interactive SEP IRA calculator.

SEP IRA Calculator Outputs. SEP-IRA Plan Maximum Contribution Calculator. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

Do Your Investments Align with Your Goals. Learn About Contribution Limits. 401k Rollover to IRA.

Ad Discover The Traditional IRA That May Be Right For You. How do I calculate my SEP contribution. Annual contributions can be made into a SEP IRA up to 25 of W-2 income.

SEP IRA Contribution Limits The 2022 SEP IRA contribution limit is 61000 and the 2021 SEP IRA contribution limit is 58000. SEP-IRA Contribution Limits. All SEP-IRA contributions are considered to be made by employers on behalf of their workers.

Simply enter your name age and income and click Calculate. An Individual 401 k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan. You can contribute up to 25 of employee compensation or 61000 in 2022 whichever is less.

An employer may establish a SEP IRA for an employee who is entitled to a contribution under the SEP plan even if the employee is unable or unwilling to establish a SEP IRA per IRS rulesSee 5305-SEP. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Retirement plan contributions are often calculated based on participant compensation.

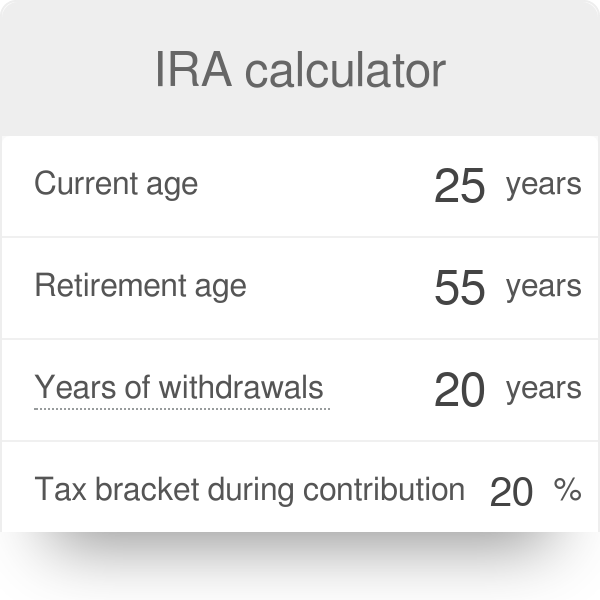

S corporation C corporation or an LLC taxed as a corporation For incorporated businesses compensation is based on W-2 income. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. The SEP IRA calculator will use this information to calculate how much youll be required to contribute to your employee accounts based on your own contribution rate.

Each option has distinct features and amounts that can be contributed to the plan each. If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your SEP IRA contribution. Schwab Has 247 Professional Guidance.

You can contribute up to 25 percent of your adjusted net earnings from self-employment to a SEP IRA or the yearly dollar limit whichever is less. Suppose your net earnings total 200000.

Sep Ira Calculator Sepira Com

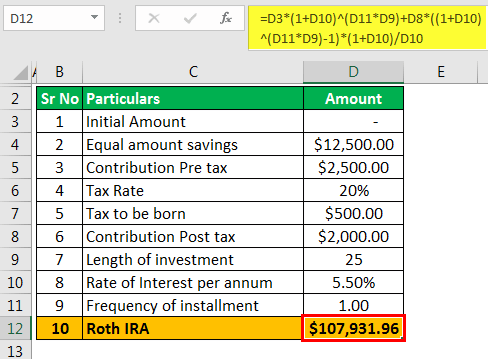

Roth Ira Conversion Calculator Excel

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

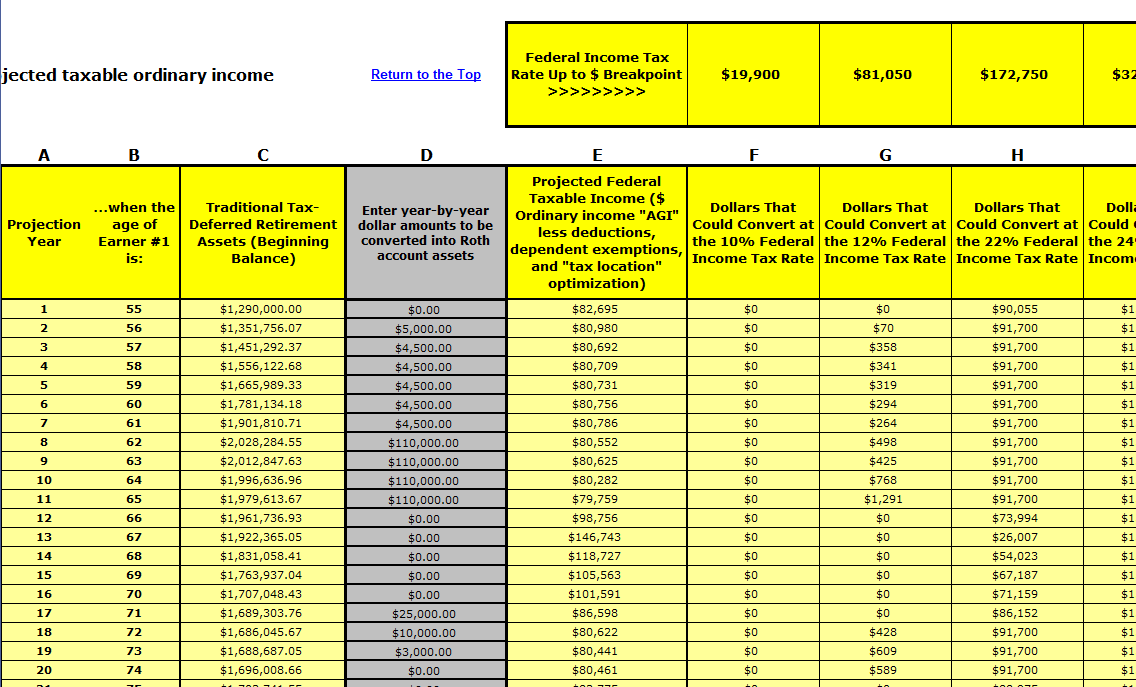

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Free Simple Ira Calculator Contribution Limits

Sep Ira Plan Br Maximum Contribution Calculator

Compound Interest Calculator Roth Ira Sale 57 Off Www Ingeniovirtual Com

Roth Ira Calculators

Ira Calculator See What You Ll Have Saved Dqydj

Sep Ira Contribution Calculator For Self Employed Persons

Sep Ira Calculator Ruby Money

How To Calculate Sep Ira Contributions For An S Corporation Youtube

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

How Simple Ira Matching Works Youtube

Retirement Calculator 401k Clearance 58 Off Www Ingeniovirtual Com

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Ira Calculator